- Senior Scam Alerts

- Posts

- 🚨 Criminal Arrested in $51 Million Tech Scam Targeting Seniors

🚨 Criminal Arrested in $51 Million Tech Scam Targeting Seniors

Brave victim comes forward to help police catch the criminal

WEEKLY SCAM ALERTS

Week of September 1, 2025

SENIOR SCAM NEWS

🚨 Criminal Arrested in $51 Million Tech Scam Targeting Seniors

This week’s case reads like a movie. An elderly San Angelo resident was convinced his computer had been “locked by a government agency.” The caller said the only way to protect his accounts was to withdraw his savings and convert it to gold bars for “safe keeping.” Over four separate meet-ups around town, couriers collected nearly $900,000 in gold.

Fortunately, the victim reported the scam on July 24, 2025, which triggered an investigation that now links the same suspect to more than $51 million in losses across the Dallas–Fort Worth and East Texas regions. This victim’s brave efforts will help this criminal from continuing to prey on other seniors.

How the case broke open

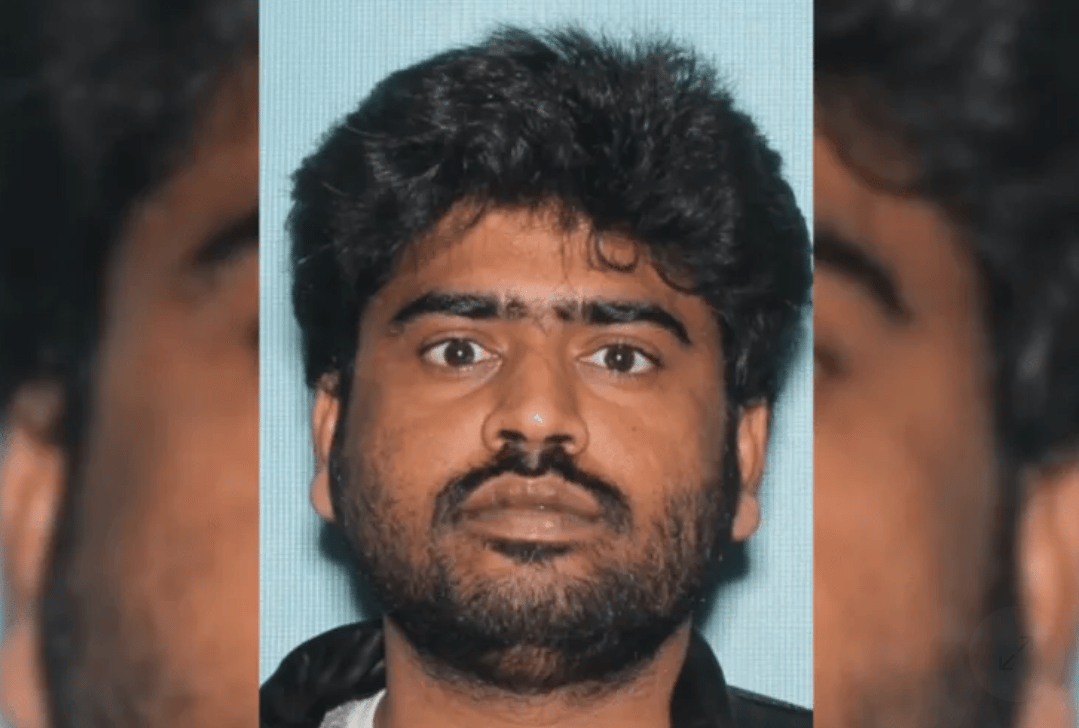

San Angelo Detective Russell took over the case on July 31. Surveillance video captured one of the pickups at a southwest convenience store. From the footage, vehicle records, and a driver’s license photo, investigators identified the suspect as Muthukrishnan Palraj, in the United States on a work visa.

Muthukrishnan Palraj, arrested in senior scams amounting to over $51 million

A statewide bulletin went out. Agencies from the Texas Department of Public Safety to the Collin County Sheriff’s Office, Colleyville PD, Irving PD, the U.S. Department of State, and U.S. Customs and Border Protection joined in. DFW investigators quickly tied Palraj to additional, similar scams in their jurisdictions.

On August 6, Detective Russell presented a probable cause affidavit for Financial Abuse of the Elderly over $150,000 (a first-degree felony). A warrant was issued; Palraj was arrested August 11 in the Dallas–Fort Worth area. State and federal prosecutions are underway. After serving any sentence, authorities say he will be deported.

The playbook: government impersonation + gold handoffs

This is a hybrid of tech-support fraud and government-impersonation fraud with a “courier” twist:

The trigger: A pop-up or call claims your computer is locked or your identity is under federal investigation.

Authority & urgency: The caller masquerades as a “federal agent,” “Treasury investigator,” or “Microsoft/Apple security,” warning that your money will be seized.

Isolation: You’re told to keep this secret—not even your banker or family can know—or you’ll “jeopardize the case.”

Asset conversion: You’re instructed to withdraw cash and buy gold bars (or sometimes cashiers’ checks or cryptocurrency).

The pickup: A “courier” or ride-share driver meets you at a neutral site (a parking lot, convenience store, or outside your home) to “secure evidence.” Multiple pickups are common.

Why gold? It’s fast to move, difficult to trace, and often bypasses bank fraud controls that would flag large wire transfers.

Red flags that stood out in this case

A demand to buy gold (or crypto) to “protect” your money.

A claim that computers or phones have been locked by the government.

Pressure to keep it secret from your bank and family.

A request to hand assets to a stranger or a ride-share driver.

Multiple meetings to collect more gold or cash after the first handoff.

Protect yourself (and your parents) right now

Shut it down, don’t call back. If you get a pop-up or a call claiming to be a government or tech company, hang up. Power down your device. If needed, take it to a trusted local technician—not a number given by the pop-up.

Banks & metals dealers: build speed bumps. Ask your bank to add withdrawal alerts, a second-person verification for large cash withdrawals, and a “trusted contact” note. If you or a loved one buys precious metals, ask the dealer to call your bank’s fraud desk before completing unusual, high-dollar purchases.

No secrecy rules. Real officials never demand secrecy or tell you not to speak to your bank or family.

Create a family plan. Agree on a code word for emergencies and a rule to call back using a known number—never a number supplied by the caller.

After any suspicious event:

Run a malware/antivirus scan and update your device.

Ask your bank for a fraud review of recent activity.

Place a fraud alert with one credit bureau (it propagates to the others).

If you’ve already handed over cash or gold

Time matters. Report this as quickly as possible in hopes of recovering lost funds, catching the criminal, and protecting potential victims. Here’s what to do as quickly as possible:

Call local police to report the crime and request an incident number.

Contact your bank’s fraud department and the metals dealer (if used); provide receipts, dates, and serial numbers if available.

File at IC3.gov (the FBI’s Internet Crime Complaint Center).

Save all texts, caller IDs, pop-up screenshots, receipts, courier details, and surveillance timestamps if you have them.

Why this arrest matters

This San Angelo case shows how a single report can unravel a far larger network. The rapid coordination among local agencies, DPS, federal partners, and border authorities turned one victim’s courage into a statewide warning—and a major arrest.

But here’s the hard truth: as long as scammers can provoke fear and rush people into secrecy, they’ll find new victims. Awareness is your shield.

Your Voice Could Be the Turning Point

If something feels wrong—it probably is.

Scammers count on silence. They rely on embarrassment to keep you quiet. But reporting a scam doesn’t make you a victim—it makes you part of the solution.

Whether you caught the scam in time or handed over money, your story can help catch criminals, protect others, and recover losses.

📢 What To Do If You’ve Been Targeted

If you're over 60 or helping a loved one navigate fraud, take action right away:

📞 Call the National Elder Fraud Hotline:

1-833-FRAUD-11 (1-833-372-8311)

Trained professionals will guide you through the next steps—confidentially and with compassion.💻 Report it online at the FBI’s Internet Crime Complaint Center:

www.ic3.gov🚔 Contact your local police department, even if the scam “didn’t work.” Every report builds a case.

What to Include in Your Report:

✅ Names, emails, phone numbers, ride-share details, or license plates used by the scammer

✅ Any websites, pop-ups, or messages involved

✅ Amounts, dates, and how the assets were moved (cash, gold, crypto, wires)

✅ Screenshots, receipts, or surveillance references, if available

Stay sharp, share this with someone you love, and remember: no government agency will ever ask you to buy gold.